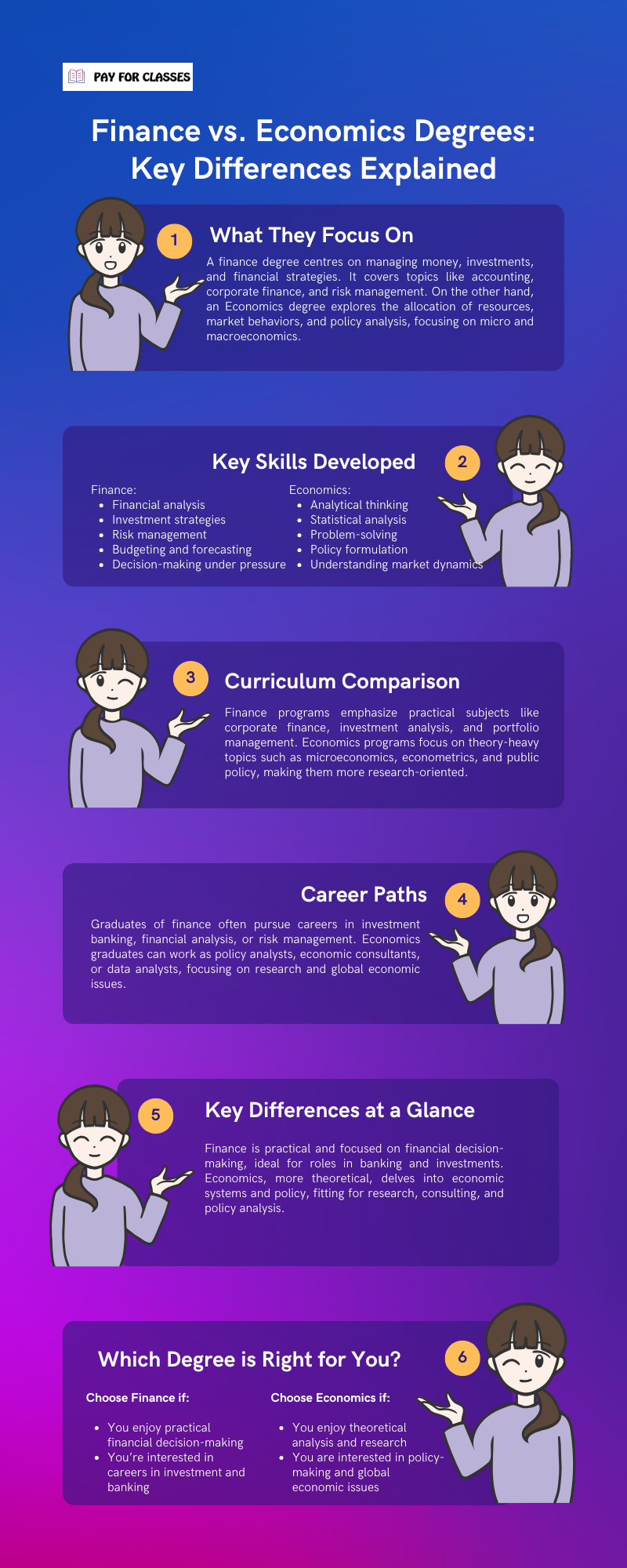

Choosing the right degree can be critical in moulding your career and future. Finance and Economics are two fields of study that often attract students, but students struggle to understand their differences. Though both fields share a similar footing, with many overlaps in market analysis and resource allocation sectors, they have differing focuses and career trajectories.

Finance focuses on the practical aspects, such as managing money, investments, and financial systems, whereas Economics dives deeper into understanding overall economic functioning and theories behind resource distribution. This blog will demystify the differences between these two trending degrees based on their curriculum, skill set, and job prospects.

So, whether you are captivated by the fast-paced environment of finance, or interested in the theoretical nuances of economics, this guide will give you the insight you need to make an informed decision on which path best suits your interests and ambitions. Moreover, if you want to pursue any of these fields from the comfort of your home then there are several universities offering online Finance and Economics degrees. Furthermore, if you come across technical or unforeseen complexities while pursuing your degrees online, you can hire subject matter experts. With just one request, such as, whom can I ask to do my online class, you can get connected to the experts who would not only help you overcome the technical or unforeseen complexity but ease your educational journey. Additionally, they will provide you with valuable guidance.

Defining Finance and Economics

What is finance?

Finance is the science of money, investment, and cash flow. It analyzes the ways people, companies, and organizations use resources to maximize gain and minimize risk. Moreover, it is a very applied field that focuses on the tools and techniques used to manage financial assets and make investment decisions to maximize a return. From corporate finance to personal finance or investment banking, finding the most efficient way to maximize financial performance and use capital efficiently is at the core of finance.

What is economics?

Economics is how societies manage finite resources against infinite needs/wants. Moreover, it studies how people, companies and governments behave to determine the production and consumption of goods and services. Economics tends to be more theoretical and deals with ideas such as supply and demand, equilibrium in markets, and economic policy. Furthermore, it can generally be divided into microeconomics (the study of individual and business-level decision-making) and macroeconomics (the study of national and global economic trend analysis).

Although both fields share elements of resource management, Finance becomes more actionable-average strategies and decision-making, while Economics addresses the conceptual aspects of economic systems at and low level.

Also read: The Basics of Microeconomics and Its Relevance Today

Curriculum Comparison of Finance and Economics

Finance degree courses

The finance program aims to give a practical focus to students to handle financial resources and analyze investments. Core courses often include:

- Corporate finance: The study of how companies manage their capital and how they decide where to invest their money

- Investment analysis: Using stocks, bonds, and other assets to maximize returns.

- Risk management: How to recognize and minimize financial risks

- Financial modelling: Employing quantitative tools to project and evaluate financial performance.

- Portfolio management: Building and managing portfolios of investments to achieve specific objectives.

Since finance degrees focus on quantitative business analysis, they approach problem-solving differently and typically require the use of specific tools such as Excel, Bloomberg, and other financial software. Moreover, an educational approach that relies on math to analyze financial data tends to shock students since it may not be something they initially expected during a course credited for its heavy math component. However, in such cases putting inquiries online, for example, where can I find an expert to take my online math class, can help you to get a strong mathematical basis. It is essential for mastering finance subjects. Additionally, it helps students who could be balancing a lot of obligations, including keeping up with schoolwork or overcoming a concept-related difficulty, so they do not fall behind on their assignments.

Economics degree courses

Economics programs emphasize an in-depth knowledge of the workings and theories of economic systems. Common courses include:

- Microeconomics: The behaviour of individuals and businesses in decision-making

- Macroeconomics Studying big-picture economic factors on a national and global scale such as GDP, inflation, and unemployment

- Econometrics: A branch of economics dealing with the application of statistical methods to economic data to give empirical content to economic relationships.

- Development economics: The study of the factors that lead to economic growth and development.

- Policy analysis: Measuring the effects of government policies on economies.

The combination of theory in an economics degree with research that derives from data needs to be mathematically modelled, and rationalized and is an ideal mix of inputs to foster such a critical mentality.

Key difference

Although both finance and economics require strong analytical abilities, Finance asks the question of the “how”—how to make sound financial decisions—and Economics explains the “why”—why economic systems work the way they do.

Skill Sets Developed in Finance and Economics Degrees

Finance graduates

Finance draws upon skills that can help with the management of money, markets, and other fields that see money as a non-neutral entity. Key skills include:

- Analytical skills: Analyzing financial information to evaluate investment possibilities and potential risks.

- Problem-solving: Developing plans for maximizing resources and increasing profits.

- Technical skills: Proficiency with instruments such as Excel, financial modelling software, and risk management systems.

- Attention to detail: Accuracy in compiling reports and following compliance measures.

- Decision making: Understanding the trade-offs and rapid financial choices that they must make to obtain maximum returns.

Such skills help the graduates pursue a career in investment banking, financial analysis, and corporations.

Economics graduates

Economics programs equip you with a solid theoretical and empirical framework for analyzing complex economic problems. Key skills include:

- Critical thinking- Approach the problem of the economy from different angles before figuring out the solutions.

- Research proficiency: Performing in-depth studies using econometric (statistical) tools.

- Quantitative analysis: One of the quantitative mathematical models applied to enhance a concept to understand and anticipate economic developments.

- Policy analysis: Assessing economic policy effects and providing recommendations.

- Logical reasoning: Knowing the relation between the aspects of cause & effect in an economy.

These skills are transferable skills into academia, government positions, policy research, and consulting.

Key difference

Finance graduates are better suited for practical knowledge and real-world financial management. Whereas, Economics graduates are adept in understanding and analyzing the economic system as a whole and broader trends. Analytical skills form the backbone of both finance and economics. However, the way they are applied is very different.

Also read: How Rising Inflation Affects the Global Economy

Career Opportunities for Finance and Economics Graduates

Finance careers

Certain career paths require a degree in Finance, which is more tailored towards the management and growth of financial resources. Popular career paths include:

- Investment banker: Enabling businesses to raise capital, and aiding the merger and acquisition of businesses.

- Financial analyst: Investors and businesses seek someone to assess investment opportunities and advise them on financial decisions.

- Portfolio manager (portfolio management): The act of managing an investment portfolio for an individual or an institution to grow investment returns.

- Risk manager: Assessing and minimizing financial risks.

- Corporate finance officer: Responsible for a corporation’s financial planning, budgeting, and resource management.

Students who opt for the finance job will be commonly working with BSA, Financial companies, and in services that take place in the high-paced spread financial environment, banks, investment firms, and corporate jobs where you must take absolute care with every decision that you make and every expansion that you do.

Economics careers

Economic positions all incorporate research, policy-making, and advisory roles (economics degrees). Here are some of the most common career paths:

- Economic consultant: Working for either businesses or governments, you will be tasked with providing insight into trends, economic conditions, or other data.

- Policy analyst: Assessing and creating policies that involve trade, health care, or education.

- Data analyst: Use of statistical tools to interpret economic data and develop patterns.

- Research economist: A research economist is typically someone who does in-depth studies of economic logic and problems.

- International trade specialist: Helping companies understand trade treaties and the international economy.

From government agencies to research organizations both national and international, to consultancy firms, economics graduates mostly work in areas where they rigorously promote theory, think critically, and are encouraged to apply it as well. Moreover, as mentioned in paragraphs prior, economics relies on intricate data analysis and math modelling, often necessitating a deep knowledge of calculus. But for students who are finding these more advanced ideas hard to understand, particularly in the time frame of a set deadline, they may be tempted to pay someone to do their online calculus class for them and help ensure they know the required mathematical concepts. In doing so, they can remain on target with their courses while concentrating on the concepts and analytical stuff of their level in economics.

Key difference

While Economics careers are more theoretical-oriented in addressing sky-scraping economic problems, Finance careers are more applicative, referencing directly to investment and lending-related questions. Both finance and economics are rewarding paths to take, but the latter will depend on individual interests and career goals.

Similarities and Overlaps in Finance and Economics

Finance and economics are based on the same foundations of analytics. Moreover, they both provide methods for resource allocation and facilitate decision-making. Both fields involve high-level mathematical, data analysis, and critical thinking skills to analyze financial and economic trends. Furthermore, market behaviour, risk assessment, and investment evaluation are some of the ideas entwined in both degrees, albeit with differing applications.

An economist might study the effects of interest rates on an economy, while a finance professional studies the effects on a personal investment portfolio. Like statisticians, both professions use statistical modelling and forecasting to make predictions and guide decisions about strategy.

The commonality among them means that many jobs will benefit from cross-functional roles. For example, financial analysts utilizing forecasting capabilities or economists who apply financial principles in their assessments. Their areas of study are not the same, but the overlap is significant enough that graduates from both finance and economics can work together comfortably in fields such as banking, consulting, and government.

Which Degree is Right for You?

Deciding between Finance and Economics will come down to what you want to do with your career, what you enjoy, and how you learn best.

Choose finance if you:

- Appreciate applying theory to real-life problems, and working with numbers in tangible situations.

- Are looking for jobs in investment banking, corporate finance, or financial planning.

- Flourish in an environment where paths must be decided quickly and accurately.

Choose economics if you:

- Are interested in why an economy works as it does or the theory behind how a market operates?

- Want to get into policy-making, research, or academia?

- Have a passion for understanding complex systems and creating solutions to social problems.

Both finance and economics also provide versatile skill sets, but a Finance major will focus on how to implement financial strategies, whereas the Economics major will be focused on the economic theory of the larger economic ecosystem. Consider what you are passionate about and what you want to do in the long run and choose the degree that suits your idea of the future the best.

Conclusion

Finance careers are distinct yet complementary to those in economics, or the other way around. Moreover, finance prepares students for careers in asset management, corporate finance, and banking by focusing on applied aspects of risk analysis, investments, and financial management. However, economics emphasizes the study of economic theories, systems, and policies, paving the way for jobs in consulting, policy analysis, and research. Although they are applied differently, they both offer superior analytical thinking and problem-solving abilities. Whether you prefer a more theoretical analysis of economic systems or a more practical concentration on finance will ultimately determine which degree is ideal for you. Select the option that best fits your interests and long-term professional goals.

Frequently Asked Questions

Question: What is the difference between finance and economics degrees?

Answer: Finance is a subject related to the practical aspects of money management, investments, and financial systems. On the contrary, economics is all about economic theories, policies, and how resources are allocated on both territories, micro and macro. If you want to join some roles in investment banking and corporate finance, then finance prepares you, while economics leads to jobs in policy analysis, research, and consultancies.

Question: Which degree is best for investment banking?

Answer: A Finance degree is increasingly preferred for careers in investment banking. You will acquire critical skills in financial analysis, risk management, and investment strategies that are applicable to positions in this area.