People must be provided with the information and tools needed to understand the situation of our economy. In the current economic climate, there is a lot of discussion about inflation. Also, how it impacts people in our nation and around the world. Every aspect of our society is affected by this economic crisis. So it is crucial for all of our locals to remain informed about it. Prices will normally rise in a healthy economy; this is referred to as inflation. As a buyer, you will not like that, but average price growth is a sign of a robust, rising economy. Now, let us read this blog written by Pay for Classes to understand the effects of inflation on the global economy.

The US Federal Reserve now thinks that the ideal pace of economic growth is shown by an inflation rate of 2%. This is roughly where it is right now. However, the economy is weak, which would cause inflation to fall below its target. This is something that must be avoided at all costs, according to the Federal Reserve and other financial analysts.

In addition to this, if you are a student who finds economics class tough and wants someone to help, remember, you can always hire an expert online. Just post your query online, for example, I want someone to do my online class and get expert assistance right away.

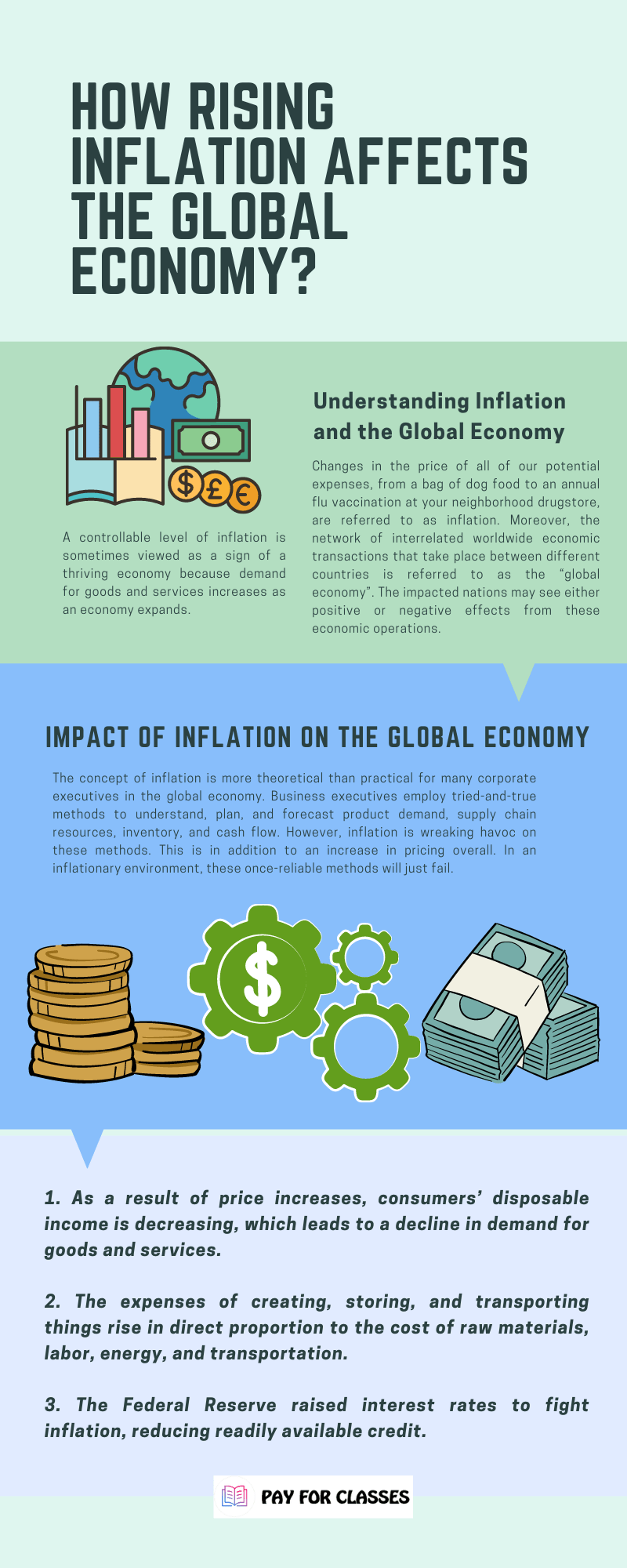

Understanding Inflation and the Global Economy

Changes in the price of all of our potential expenses, from a bag of dog food to an annual flu vaccination at your neighbourhood drugstore, are referred to as inflation. Moreover, the network of interrelated worldwide economic transactions that take place between different countries is referred to as the “global economy”. The impacted nations may see either positive or negative effects from these economic operations.

A controllable level of inflation is sometimes viewed as a sign of a thriving economy because demand for goods and services increases as an economy expands. As suppliers work to meet the rising demand, prices rise slightly as they attempt to meet the demands of consumers and businesses. A terrible cycle that starts when inflation rises too much or vice versa might wreck our economy. Numerous detrimental effects of high inflation are seen in the global economy. Workers’ take-home income rapidly depreciates when job compensation can no longer keep up with the inflation of retail prices.

This is a major issue for low-income households due to the potentially disastrous implications of any increase in the price of any commodity or service. The effects of workers’ demand for wage increases may be higher labor expenses and reduced benefits for employers. A large degree of economic fragility might result from these expansion-related side effects, which discourages other people from taking chances when beginning their own enterprises.

Moreover, do you find yourself struggling with your online classes? Do you also ask yourself questions like, can I pay someone to take my online calculus class for me or others? If yes! then contact us now for the assistance.

Also read: Artificial intelligence (AI) is Not Only Destructive; Outline of AI for Social Good

Impact of Inflation on the Global Economy

The concept of inflation is more theoretical than practical for many corporate executives in the global economy. Business executives employ tried methods to understand, plan, and calculate product demand, supply chain resources, inventory, and cash flow. However, inflation is dangerous havoc on these methods. This is in addition to an increase in pricing overall. In an inflationary environment, these once-reliable methods will just fail.

1. As a result of price increases, consumers’ disposable income is decreasing. It leads to a decline in demand for goods and services.

Consumers are particularly burdened by the rising cost of food, rent or mortgage, and gasoline, which leaves them with less money for non-essentials. Your business must therefore improve its capacity for foreseeing, forecasting, and identifying consumer behavior. These abilities are what power transportation, manufacturing, inventory management, and the acquisition of raw materials. To more accurately estimate future-looking product mixes and quantities, demand forecasting must take into account leading market indicators, current consumer trends, and other outer data signals.

2. The expenses of creating, storing, and transporting things rise in direct proportion to the cost of raw materials, labor, energy, and transportation.

Regarding input costs, it seems like the ideal storm is about to occur. Because supplies are expensive and in short supply, shipping what is available to your factories and warehouses takes longer and costs more money. The Great Resignation is occurring concurrently, which raises the cost of labor. The margins have been greatly effected by everything mentioned. It is necessary to enhance the management of materials and resources.

3. The Federal Reserve raised interest rates to fight inflation, reducing readily available credit.

As a result, you must now pay particular attention to and manage working capital and inventory buffers ideally. This is significant . Because you would not want to borrow money at a high-interest rate when your company needs cash. Also, while keeping your capital locked up in unsold goods. In order to manage available inventory based on real-time changes in supply and demand, you must be aware of the specific needs.

Also, contact us for online class assistance when you have queries like, I wish someone to take my online algebra class for me.

Conclusion

The global economy will regularly respond to a cash shortage when people are less inclined to store money. There would surely be higher interest rates in this situation since banks will have less money to offer. One of the few ways an economy may strangle itself into a stall is by doing this. Businesses and mortgage holders may be compelled to go into default if interest rates rise to lower the amount being borrowed and an economic downturn results.

Frequently Asked Questions

Question: 1 What are the top three reasons why inflation occurs?

Answer: 1 Cost-push inflation, demand-pull inflation, and built-in inflation are the three main causes of inflation.

Question: 2 Who benefits when prices rise?

Answer: 2 Those with fixed-price, low-interest mortgages and some stock lender gain from rise in price. It has a particularly bad effect on people and families with fixed incomes who hold debt with changing interest rates.